carbon1.ru

Learn

Refinance Car Loan Pros And Cons

The main purpose of refinancing a car is to get a lower interest rate, which will save you money over the long run. Higher interest rates - When comparing interest rates against other common loans (for example, mortgage and new car loans), used car loan rates are typically. Pros of refinancing an auto loan · Benefiting from an improved credit score · Extending your repayment term · Shortening your repayment term · Taking advantage. Afterwards, you will start making payments to your new lender and enjoying the benefits of your refinance. Equifax Credit Monitoring. Sign up for a credit. pros and cons of an auto loan refinance before you apply Since Credit Union of Colorado offers interest rates lower than most car dealerships and a. Lower interest means lower monthly payments and less money paid over the entire loan. If current interest rates are lower than your existing auto loan rate, you. Pros of Refinancing an Auto Loan · Lower interest rate: One of the best reasons to refinance a car loan is to lower your interest rate. · Lower monthly payments. Pros of Refinancing a Car · Potential Savings in Interest · Improved Cash Flow · Pay Off the Loan Earlier · Tap Into Car's Equity. Refinancing your auto loan could result in a lower interest rate, which means you'll pay less over the life of the loan. The main purpose of refinancing a car is to get a lower interest rate, which will save you money over the long run. Higher interest rates - When comparing interest rates against other common loans (for example, mortgage and new car loans), used car loan rates are typically. Pros of refinancing an auto loan · Benefiting from an improved credit score · Extending your repayment term · Shortening your repayment term · Taking advantage. Afterwards, you will start making payments to your new lender and enjoying the benefits of your refinance. Equifax Credit Monitoring. Sign up for a credit. pros and cons of an auto loan refinance before you apply Since Credit Union of Colorado offers interest rates lower than most car dealerships and a. Lower interest means lower monthly payments and less money paid over the entire loan. If current interest rates are lower than your existing auto loan rate, you. Pros of Refinancing an Auto Loan · Lower interest rate: One of the best reasons to refinance a car loan is to lower your interest rate. · Lower monthly payments. Pros of Refinancing a Car · Potential Savings in Interest · Improved Cash Flow · Pay Off the Loan Earlier · Tap Into Car's Equity. Refinancing your auto loan could result in a lower interest rate, which means you'll pay less over the life of the loan.

Steps to Refinance Car Loans · #1 Weigh the Pros and Cons of Refinancing Your Car · #2 Check Your Credit Scores · #3 Gather Information and Documents · #4 Research. pros and cons of an auto loan refinance before you apply Since Credit Union of Colorado offers interest rates lower than most car dealerships and a. Decrease in market interest rates: If interest rates on auto loans, in general, have gone down since you took out your loan, refinancing can be a wise choice. You can pay the loan off faster, especially if you also have a new shorter loan term at the same time. While you won't see the benefits to your credit in the. In many cases, refinancing is a great way to lower your monthly payment, improve your cash flow, and consolidate debt. Interest rates are also fixed, so you will know what to expect with your monthly payments. Pros. Usually a lower interest rate than on a personal loan. Among the pros and cons of refinancing a car is it may provide you with a lower interest rate (pro) while temporarily causing your credit score to drop from a. Lower Interest Rate. One of the most common – and financially beneficial – reasons to refinance your car loan is to reduce your interest rates. · Lower Payments. The benefits of refinancing your mortgage · a lower interest rate (APR) · a lower monthly payment · a shorter payoff term · eliminate private mortgage insurance . However, there are a few disadvantages that come along with car refinancing as well. Refinancing can come with extra fees due to new loan applications and early. Choose to refinance when interest rates have dropped or your credit has improved. Avoid refinancing if you are upside down on your auto loan. Check lender. Refinancing Auto Loans: An Overview · Benefits of Refinancing · #1: Refinancing an Auto Loan Lowers Your Interest Rate. Of course that assumes there is no refinance fee or loan payoff fee or penalty. As for pros, the idea is to save money with a lower interest. The most common reason to refinance a car is usually to lower one's car loan monthly payment. With increasing vehicle costs, more people are looking to save on. Refinancing your auto loan essentially means replacing your current loan with a new one, often with more favorable terms or a different lender. Refinancing your auto loan at a lower interest rate can have a positive impact on the overall cost of your vehicle loan, saving you money over time by paying. If you have been consistently repaying your loan on time and notice that your credit score has gone up, you may be able to apply for refinancing and secure. Pros · Lower monthly payments: Refinancing gives you a chance to snag a lower interest rate or extend your loan term, and both can potentially lower your monthly. If you didn't have much experience with credit when you purchased your vehicle, refinancing could benefit you. Interest rates as high as 18 percent are common. When should you refinance a car loan? · When you bought your vehicle at an interest rate higher than 6 or 7%. Refinancing to a lower rate can help you save over.

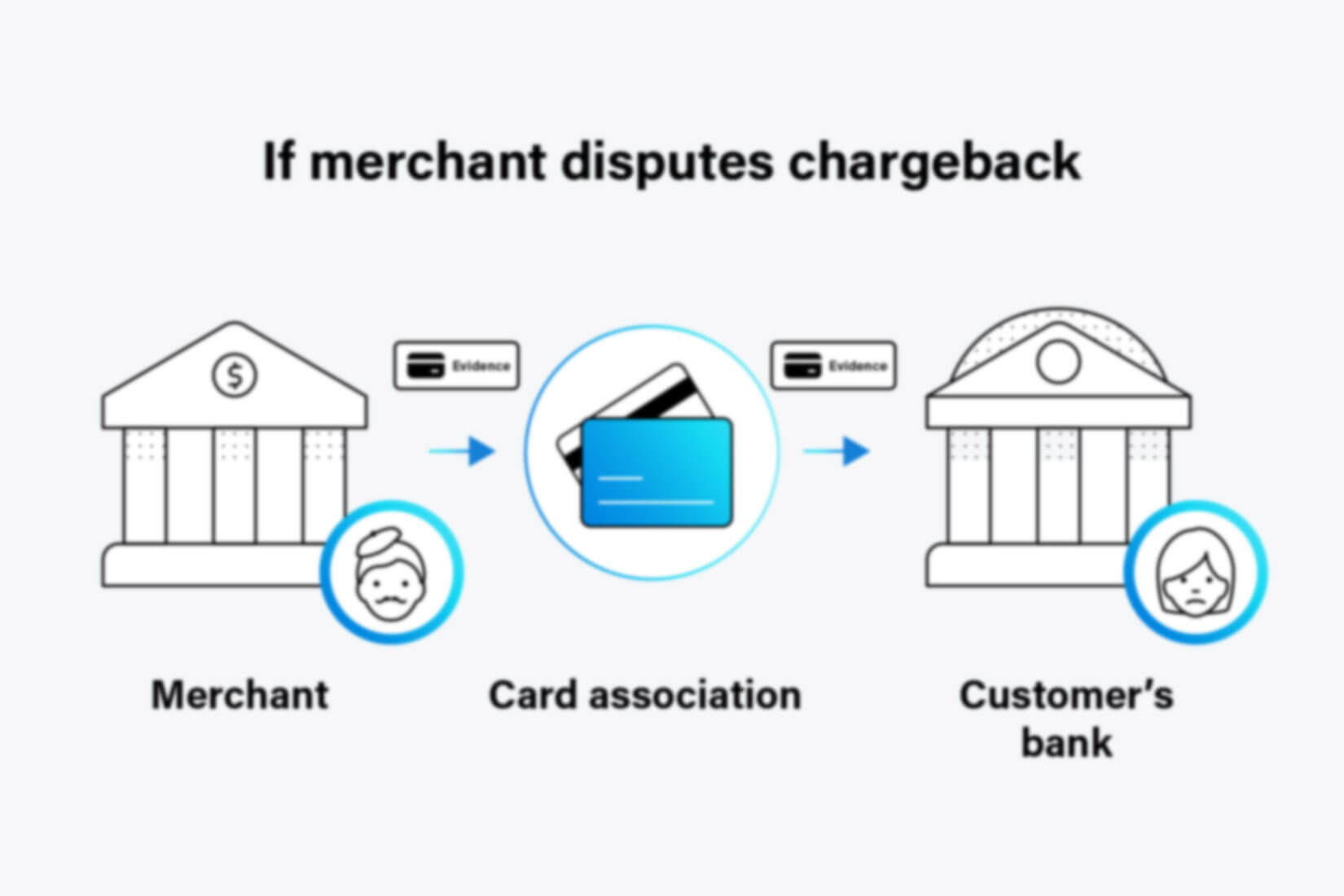

Credit Charge Back

A chargeback occurs when the amount of the original charge that was credited to your business checking account is reversed. The issuing bank charges all or part. In this comprehensive guide, we'll delve into the intricacies of credit card chargebacks, exploring their nuances from both the consumer and merchant/banking. Chargebacks are a consumer protection tool that allow consumers to get their money back for fraudulent charges or purchases that don't live up to standards. In simple terms, a chargeback is where money paid to a retailer for an item is reversed out of its account and refunded to yours. Chargeback rules are set by. If you notice a mistake such as a purchase being charged to your card twice, contact the merchant directly to request a refund or assistance. Here are the main. No fees or interest will be incurred on the disputed charge during the dispute process. If the transaction was posted in error, we will correct your account. If. A chargeback is a process where you ask your credit card company to reverse a payment and refund your money. You'll need to contact your credit. A chargeback, also referred to as a payment dispute, occurs when a cardholder questions a transaction and asks their card-issuing bank to reverse it. A disputed charge, or chargeback, describes the process that occurs once a cardholder refuses to accept responsibility for a charge on their credit or debit. A chargeback occurs when the amount of the original charge that was credited to your business checking account is reversed. The issuing bank charges all or part. In this comprehensive guide, we'll delve into the intricacies of credit card chargebacks, exploring their nuances from both the consumer and merchant/banking. Chargebacks are a consumer protection tool that allow consumers to get their money back for fraudulent charges or purchases that don't live up to standards. In simple terms, a chargeback is where money paid to a retailer for an item is reversed out of its account and refunded to yours. Chargeback rules are set by. If you notice a mistake such as a purchase being charged to your card twice, contact the merchant directly to request a refund or assistance. Here are the main. No fees or interest will be incurred on the disputed charge during the dispute process. If the transaction was posted in error, we will correct your account. If. A chargeback is a process where you ask your credit card company to reverse a payment and refund your money. You'll need to contact your credit. A chargeback, also referred to as a payment dispute, occurs when a cardholder questions a transaction and asks their card-issuing bank to reverse it. A disputed charge, or chargeback, describes the process that occurs once a cardholder refuses to accept responsibility for a charge on their credit or debit.

Chargeback fraud is when a person knowingly makes a purchase with a credit card, then disputes the charge with their credit card provider. A chargeback is a return of money to a payer of a transaction, especially a credit card transaction. Most commonly the payer is a consumer. The chargeback. A chargeback is the potential outcome of a disputed credit or debit card transaction. If the cardholder's bank accepts the dispute, they will reverse the. A chargeback occurs when a customer files a complaint with their bank regarding a fraudulent or suspicious charge. If you paid with a Visa debit, credit or pre-paid card, a chargeback is an option. If you need to make a chargeback claim, make sure you do it within days. For day-to-day bank account and credit card transactions or charges, call Last updated January 4, Back to Popular questions. A credit card chargeback is when a bank reverses an electronic payment to trigger a dispute resolution process. Chargeback exists for both credit and debit card purchases. It is a mechanism for your card provider to reclaim money from the retailer's bank. Chargebacks are the primary tool banks use to resolve credit card payment disputes. Cardholders benefit from the system, which acts as a shield against. With chargeback, you only get back the amount you originally put on the card. That makes it different to Section 75, which pays out the full cost even if you'd. A chargeback is like a refund - it reverses a transaction made on a debit or credit card. Chargeback is a term used by credit and debit card providers. If you send your letter certified mail and ask for a return receipt, that gives you proof of what the issuer got. Include copies (not originals) of receipts or. When a customer disputes a purchase on their debit or credit card—triggering the chargeback process—the merchant can try to stop the chargeback by proving the. To dispute a charge, send a letter to your credit card company's address for billing inquiries or errors. Your credit card company will investigate the dispute. A chargeback is the potential outcome of a disputed credit or debit card transaction. If the cardholder's bank accepts the dispute, they will reverse the. A credit card chargeback occurs when a cardholder disputes a charge on their credit card statement and asks the card issuer to reverse the transaction. It is. A credit card chargeback is a process in which a card owner can reclaim money directly from the issuer after disputing a purchase charge. Chargebacks can lead to you having to pay higher bank fees and in severe cases, card networks and credit card payment facilitators such as SumUp can revoke your. One of the most convenient ways to report a problem with a charge is in the Capital One app or on the website. To start your dispute, select the transaction. (The reimbursement exists as a temporary credit for the cardholder and can be later transferred back to the merchant should they win the chargeback dispute.).

Forex Trade Forecast

EUR/USD outlook could be impacted by key inflation data from Eurozone and US this week, as euro makes positive start to new week and dollar falls. EUR/USD. Forex news from ForexLive. The fastest Foreign Exchange market reporting and analysis. Live Forex and economic news. Technical analysis, headlines, Live. Check out the latest ideas and forecasts on Forex market from top authors of TradingView community. Our users share their predictions and technical outlook. Access expert analysis on FXEmpire. Stay updated with comprehensive forecasts and live prices on commodities, forex, cryptocurrencies, and stock markets. Since our last FX Forecast Update, 21 June, the US economy has increasingly shown signs of weakness as reflected across both activity, inflation and labour. Explore FXEmpire's comprehensive market forecasts, in-depth analysis, and insightful price predictions to make informed decisions and enhance your trading. The EUR/CHF is a more interesting euro pair to watch, while the EUR/USD technical outlook hinges on the day average. If you want to achieve success in trading, you definitely need high-quality analytics. Unfortunately, experience has proven that not every trader is able to. The USD/RUB pair is trading near the ratio as of this writing with fluctuations persisting in a rather well known price range. Forex Daily Forecast. EUR/USD outlook could be impacted by key inflation data from Eurozone and US this week, as euro makes positive start to new week and dollar falls. EUR/USD. Forex news from ForexLive. The fastest Foreign Exchange market reporting and analysis. Live Forex and economic news. Technical analysis, headlines, Live. Check out the latest ideas and forecasts on Forex market from top authors of TradingView community. Our users share their predictions and technical outlook. Access expert analysis on FXEmpire. Stay updated with comprehensive forecasts and live prices on commodities, forex, cryptocurrencies, and stock markets. Since our last FX Forecast Update, 21 June, the US economy has increasingly shown signs of weakness as reflected across both activity, inflation and labour. Explore FXEmpire's comprehensive market forecasts, in-depth analysis, and insightful price predictions to make informed decisions and enhance your trading. The EUR/CHF is a more interesting euro pair to watch, while the EUR/USD technical outlook hinges on the day average. If you want to achieve success in trading, you definitely need high-quality analytics. Unfortunately, experience has proven that not every trader is able to. The USD/RUB pair is trading near the ratio as of this writing with fluctuations persisting in a rather well known price range. Forex Daily Forecast.

There are several indicators key to trade the forex market, and all of them are a great tool for the trader to forecast where the price can go next. There. Currency exchange rate forecasts help brokers and businesses make better decisions. · Purchasing power parity looks at the prices of goods in different countries. Forex Forecast and Elliott Wave Analysis, daily. I trade Forex market using Elliott Wave and Fibonacci. Elliott Wave Analysis channel is for educational purpose. Latest News ; USD/JPY Price Analysis: Safe-Haven Demand Lifts Dollar · 27 Aug. ; USD/CAD Outlook: CAD Strengthens Amid Rising Oil Prices · 27 Aug. Follow all the latest forex news, trading strategies, commodities reports & events at DailyFX. News / Latest Stories · ECB can gradually cut rates but jury still out on September, Knot says · US Dollar Short-term Outlook: USD Bears Slow at Fresh Yearly Low. Many forex traders have already “priced in” consensus expectations into their trading and into the market well before the report is scheduled, let alone. Here you can find daily and weekly forecasts for the major currency pairs, as well as the analysis for currency movements and trends. The EURUSD price is testing the key support base $, which urges caution from the upcoming trading, as the price needs to consolidate above this level to. TrendSpider · Eidosearch · Dailyfx · Recognia and Trading Central · Autochartlist · carbon1.ru forex analysis and forecasts, currency news. Trade ideas with push alerts. Covers major currencies including USD Dollar, EUR Euro, JPY Japanese Yen, GBP. Forex analysis, forecasts, trading signals, and commentary on major and exotic currency pairs. Sentiment analysis in Forex forecasting. Sentiment analysis involves looking at the actual positioning of various Forex market participants. Simply put, when. In order to forecast future movements in exchange rates using past market data, traders need to look for patterns and signals. Previous price movements cause. Daily analytics of the Forex market, the forecast of the exchange rate for today, overview of the Forex market for the week. Accurate forecasts and free. insights tailored to predict rate movements. Our forex predictions blend technical analysis with market trends, essential for effective trading. The essence of technical analysis is that it attempts to forecast future changes in forex trend lines by thoroughly examining past market data, particularly. Forex analysis: euro dollar forecasts and other ; How to Trade the EUR/USD Pair on August 27? Simple Tips and Trade Analysis for Beginners · Paolo Greco · Weekly Forex Forecast – Weekly Forex Trading Analyses. The Forex market is complicated, but your market analysis doesn't need to be. forecast. why to trade, what to trade and who else is trading. Minimizes Exposure Whilst Attempting to Maximize Gains. Technical Analysis.

Sign Up Phone Number For Calls

You can sign up for a toll-free number for your business through your regular phone provider. Additionally, you can forward it to an existing line and stay on. Only then, you'll be able to request access to your US phone number;; After successfully signing up, you can make business calls and texts with a US-based phone. The National Do Not Call Registry gives you a choice about whether to receive telemarketing calls. You can register your home or mobile phone for free. Create a verified Business Profile and manage your phone number verification in one place to join our fully verified communications ecosystem. Visit Trust Hub. Note: You can also sign up for the Texas do-not-call list via the phone that will identify suspected spam calls or block calls from specific numbers. Pick a number Choose the best number type for your business: Local, Toll-free, or Vanity. 3. Set up forwarding Configure call. A Voice number works on smartphones and the web so you can place and receive calls from anywhere. Save time, stay connected. Sign up with CallHippo to buy a US Number. 2. Log in with the username and password and it will redirect you to the dashboard. 3. Go to 'Numbers. Sign up for a Skype Number and get the convenience of a local number that people can call, wherever you are, on any device. You can sign up for a toll-free number for your business through your regular phone provider. Additionally, you can forward it to an existing line and stay on. Only then, you'll be able to request access to your US phone number;; After successfully signing up, you can make business calls and texts with a US-based phone. The National Do Not Call Registry gives you a choice about whether to receive telemarketing calls. You can register your home or mobile phone for free. Create a verified Business Profile and manage your phone number verification in one place to join our fully verified communications ecosystem. Visit Trust Hub. Note: You can also sign up for the Texas do-not-call list via the phone that will identify suspected spam calls or block calls from specific numbers. Pick a number Choose the best number type for your business: Local, Toll-free, or Vanity. 3. Set up forwarding Configure call. A Voice number works on smartphones and the web so you can place and receive calls from anywhere. Save time, stay connected. Sign up with CallHippo to buy a US Number. 2. Log in with the username and password and it will redirect you to the dashboard. 3. Go to 'Numbers. Sign up for a Skype Number and get the convenience of a local number that people can call, wherever you are, on any device.

Stop unwanted sales calls by registering your phone number: Online: Visit Sign up to receive email updates. Enter your email. Sign up. USAGov Contact. Sign up for a free trial of Dialpad to get set up with an online phone number for your business and start making calls in just minutes. Or, take a self-guided. With TextNow, you sign up for free to get a second phone number in your area code (or another), plus free calling and texting via the iOS and Android apps. There is no cost to get on the list. Register Online, by Mail or by Phone – To find out if your phone number has been registered to the. How to Sign Up for Spam Calls · 1. Use Automatic Number Identification (ANI) · 2. Engage in Free Trials and Surveys · 3. Sign Up for Telemarketing Calls · 4. Post. Let us handle the sign-up - it takes just 3 minutes. 3. Receive Calls Instantly view detailed information about calls made to your TollFreeForwarding phone. Say hello to the first free wireless provider on the nation's largest 5G network. Get a free TextNow phone number with unlimited calling and texting in the. Verizon has four ways to help you block calls on your home phone. If you haven't already, sign up for: Call Block; Caller ID; Anonymous Call Rejection; Caller. Hushed is the best second number app for Wi-Fi calling. Make private calls, send texts, and manage multiple numbers all on a single device. Adding Your Number to the Registry Go to carbon1.ru or call (TTY: ) from the phone you want to register. It's free. If you. Enter up to three phone numbers and email address. Click Submit. Check for errors. Click Register. If unsure, click Verify. Add your number and all the numbers. Signal installed on your Android phone or iOS device. · Signal uses your existing phone number. · The number must be able to receive an insecure SMS or phone call. Register your phone number to report stop or block unwanted, annoying,telemarketing, spam calls, robocalls to the FTC. Add a second number to your existing smart phone to manage business calls, voicemail and text. Starts at $/mo $/mo. Sign up today and instantly save. Deliver great customer service by forwarding calls to your cell phone. After you've signed up for Grasshopper, you can easily add more numbers. US virtual number for phone verification, calls & SMS for just $! Get a second phone number for business or private uses and text and call worldwide. Register your phone number to report stop or block unwanted, annoying,telemarketing, spam calls, robocalls to the FTC. When call forwarding is set up, calls to your Google Voice number will ring your linked phones. If you didn't link your device's number during sign-up, you. Create a verified Business Profile and manage your phone number verification in one place to join our fully verified communications ecosystem. Visit Trust Hub.

Does Credit Rating Affect Mortgage

A higher credit score can help you secure a lower interest rate, which can save you thousands of dollars over the life of your mortgage. To improve your credit. How Credit Reports Affect Mortgages As mentioned earlier, mortgage lenders look at your credit score, your debt-to-income ratio and other things to assess the. Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly. How can credit scores affect mortgage interest rates? The CFPB points out that your credit scores are a key ingredient in the mortgage qualification process. How does my credit score affect my mortgage? Your credit score directly affects the interest rate on your mortgage. Basically, high credit scores lower your. With mortgages, you can get your credit report pulled by additional lenders with no further impact to your credit score as long as you submit additional. + Credit Score Mortgage: How Good Credit Affects Your Rate Your credit score plays a major role in the mortgage approval process; it dictates what types of. Looking for new credit can equate with higher risk, but most Credit Scores are not affected by multiple inquiries from auto, mortgage or student loan lenders. The simple answer is yes; it absolutely affects your mortgage interest rate. The higher your score, the lower the interest rate you will usually get. A higher credit score can help you secure a lower interest rate, which can save you thousands of dollars over the life of your mortgage. To improve your credit. How Credit Reports Affect Mortgages As mentioned earlier, mortgage lenders look at your credit score, your debt-to-income ratio and other things to assess the. Your credit history might also affect your mortgage interest rate, in the sense that the types of mortgage you are offered will be affected by how responsibly. How can credit scores affect mortgage interest rates? The CFPB points out that your credit scores are a key ingredient in the mortgage qualification process. How does my credit score affect my mortgage? Your credit score directly affects the interest rate on your mortgage. Basically, high credit scores lower your. With mortgages, you can get your credit report pulled by additional lenders with no further impact to your credit score as long as you submit additional. + Credit Score Mortgage: How Good Credit Affects Your Rate Your credit score plays a major role in the mortgage approval process; it dictates what types of. Looking for new credit can equate with higher risk, but most Credit Scores are not affected by multiple inquiries from auto, mortgage or student loan lenders. The simple answer is yes; it absolutely affects your mortgage interest rate. The higher your score, the lower the interest rate you will usually get.

If you can, it might be better to wait before applying for a mortgage while your credit score repairs. Having a stable income or large deposit before applying. Everyone is different and our credit scores reflect a fraction of a lender's decision when assessing your mortgage application. Having a good credit score can. Your credit report: Your financial report card. You want all A's – Like we mentioned before, your credit score is a representation of how well you can handle. Currently federal rules require a FICO score to obtain a conventional mortgage loan. You should be aware that even one day late payment can hurt your ability. If your credit score falls in this range, you have access to all mortgage rates available on the market. That's especially true if your score is above A credit score plays a significant role in obtaining the best mortgage rates because lenders use it to assess the borrower's creditworthiness. Your credit history is one of the many factors that can affect your ability to get approved for a mortgage and a lender can pull up one of your credit. Check your credit. Your credit scores also have a major impact on the homebuying process. They can directly affect the amount of mortgage you're able to secure. There isn't a specific credit score that you need for a mortgage, but the higher your score the more likely your application will be accepted. What Do Mortgage Lenders Consider A Bad Credit Score? The minimum score required for a mortgage will vary by lender and loan type. Conventional loans have a. What credit score do you need to buy a house? We'll cover why credit scores matter in the mortgage process and how to maximize your score. A credit score. You can afford a more expensive homeYour credit score affects both your interest rate and mortgage payment, so it has an impact on how much house you can afford. In general, the higher your credit score, the lower your interest rate, and vice versa. This can have a huge impact on both your monthly payment and the amount. Your credit score and credit history are key factors in determining your eligibility for a mortgage because they demonstrate that you can manage money. But the higher your credit score, the better your chances of getting the mortgage you need. Each credit reference agency uses a slightly different scoring. If your credit score is in the highest category, , a lender might charge you percent interest for the loan. This means a monthly payment of $ A mortgage credit inquiry estimated to lower your credit score a mere points. This small hit to your credit should fade away in within a year. Credit scores often get a letter grade in mortgage lingo, as in, “He has a B-rating,” or “She is a low-scoring D borrower.” What does this mean, exactly? The. Your credit rating is one of the first things a lender will check when you apply for a mortgage. A poor score can be an instant red flag, which can prevent or. Your credit score and credit history are key factors in determining your eligibility for a mortgage because they demonstrate that you can manage money.

Are Stocks Going To Go Back Up

The Stock Market Is in the Homestretch of It's Time to Buckle Up and Branch Out. The markets are at a critical juncture, with a rate cut and. proxy online sign-up. Enroll to vote online and receive materials via email. visit proxy sign up. annual report. Learn how we're managing our energy portfolio. Buying stocks when the overall market is down can be a smart strategy if you buy the right stocks. You could pick up some blue-chip winners that will perform. While these hot stocks have performed well recently, that's in the past now. As an investor you'll need to determine whether the stocks are likely to go up in. Stocks staged a strong comeback this week as sentiment shifted around recent inflation data and how aggressive the Federal Reserve will be at next week's. Supply and demand economics are the main driver in what makes stock prices go up and down. Preventing a share price from going to zero. When a company's. I'm not going to. I'll keep investing a chunk of my paycheck every month and hope that a meteor doesn't crash into us. Limit Up-Limit Down Circuit Breaker (Single Stock Circuit Breaker) – The If the stock's price moves to the price band and does not move back within. Get the latest news on the stock market and events that move stocks, with in-depth analyses to help you make investing and trading decisions. The Stock Market Is in the Homestretch of It's Time to Buckle Up and Branch Out. The markets are at a critical juncture, with a rate cut and. proxy online sign-up. Enroll to vote online and receive materials via email. visit proxy sign up. annual report. Learn how we're managing our energy portfolio. Buying stocks when the overall market is down can be a smart strategy if you buy the right stocks. You could pick up some blue-chip winners that will perform. While these hot stocks have performed well recently, that's in the past now. As an investor you'll need to determine whether the stocks are likely to go up in. Stocks staged a strong comeback this week as sentiment shifted around recent inflation data and how aggressive the Federal Reserve will be at next week's. Supply and demand economics are the main driver in what makes stock prices go up and down. Preventing a share price from going to zero. When a company's. I'm not going to. I'll keep investing a chunk of my paycheck every month and hope that a meteor doesn't crash into us. Limit Up-Limit Down Circuit Breaker (Single Stock Circuit Breaker) – The If the stock's price moves to the price band and does not move back within. Get the latest news on the stock market and events that move stocks, with in-depth analyses to help you make investing and trading decisions.

Key takeaways · Positive news about job numbers and the unemployment rate can drive up investor optimism that the economy is growing faster than expected. · Signs. back, but this is usually just pennies on the dollar. This fact should not Can a Stock Go Negative? Technically, a company that has more debts and. Limit Up/Limit Down: In , the Securities and Exchange Commission " When a stock or many stocks in a market decline steeply and suddenly, some. Stocks could have a surprisingly strong first half of the year, though the risk of recession may loom in the second half. Watch for opportunities in value. Up-to-date stock market data coverage from CNN. Get the latest updates on US markets, world markets, stock quotes, crypto, commodities and currencies. is expected to be a transition period for the stock market, with a somewhat bumpy ride early on. Next year, investors can expect declining inflation. And, true to form, everyone has already started telling stories about how voting for their candidate will inevitably lead the financial markets going up, and. back, but this is usually just pennies on the dollar. This fact should not Can a Stock Go Negative? Technically, a company that has more debts and. I'm not going to. I'll keep investing a chunk of my paycheck every month and hope that a meteor doesn't crash into us. If you decide to invest, read our important investment notes first and remember that investments can go up and down in value, so you could get back less than. Market values usually go up and down. But what can you do, when these values drop a lot? Consider staying invested. Here's why. On this page. End-of-day trading tends to solidify the consensus established by action earlier in the day. Stocks that have been trending up typically keep rising, while. LPL Research puts the latest bout of market volatility in historical perspective and discusses what it could mean for stocks going forward. move higher in. Over the past 96 years, the S&P has gone up and down each year. In fact stocks. This index is unmanaged, and its results include reinvested. An individual stock can go to zero, so if a stock drops a lot that can certainly be a prelude to it dropping a lot more, not going back up. CONTINUE Go Back Open parent breadcrumb items. Home | US Financial Stocks are represented by the S&P Total Return Index. Bonds are. This is actually typical for moderately traded stocks. They tend to go up on anticipation of the news — before the news. Once the news comes out. proxy online sign-up. Enroll to vote online and receive materials via email. visit proxy sign up. annual report. Learn how we're managing our energy portfolio. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. stocks to buy in the coming year. I've covered this story for over a decade But the tech stock is pricey, so snap up shares on dips. Competition is.

Can You Have 401k And Ira

If you're transitioning to a new job or heading into retirement, rolling over your (k) to a Roth IRA can help you continue to save for retirement while. If you earn too much to contribute to a Roth IRA, you can still get one by converting traditional IRA or (k) money. Learn more about the potential. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. If both a (k) plan and a SEP IRA are offered by the same business, business owners can contribute to both plans simultaneously, however contributions between. In the general sense, contributing to a k does not factor to IRAs. You probably need to do backdoor Roth IRA. As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. You can contribute to an IRA even if you also have a (k), with some income limits. Roth IRA contributions are limited by your income. The short answer is yes, it's possible to have a (k) or other employer-sponsored plan at work and also make contributions to an individual retirement plan. You can contribute to both a (k) and an IRA, as long as you keep your contributions to certain limits. For , you can contribute up to $23, to a (k). If you're transitioning to a new job or heading into retirement, rolling over your (k) to a Roth IRA can help you continue to save for retirement while. If you earn too much to contribute to a Roth IRA, you can still get one by converting traditional IRA or (k) money. Learn more about the potential. You can save with both as long as you're qualified and heed contribution and income limits. Learn how an IRA and a (k) can work together. If both a (k) plan and a SEP IRA are offered by the same business, business owners can contribute to both plans simultaneously, however contributions between. In the general sense, contributing to a k does not factor to IRAs. You probably need to do backdoor Roth IRA. As a couple, you can contribute a combined total of $14, (if you're both under 50) or $16, (if you're both 50 or older) to a traditional IRA for If. You can contribute to an IRA even if you also have a (k), with some income limits. Roth IRA contributions are limited by your income. The short answer is yes, it's possible to have a (k) or other employer-sponsored plan at work and also make contributions to an individual retirement plan. You can contribute to both a (k) and an IRA, as long as you keep your contributions to certain limits. For , you can contribute up to $23, to a (k).

If you have after-tax money in your traditional (k), (b), or other workplace retirement savings account, you can roll over the original contribution. Yes. You can contribute to an IRA even if you or your jointly-filing spouse are covered by an employer-sponsored retirement plan, such as a (k). Can I roll my (k) into an IRA? Yes. If you have assets in a (k) with an employer that you no longer work for, you can roll over these assets. You can. The answer is yes. In fact, this is the most ideal situation for individuals as it allows you to take advantage of the various tax benefits of both retirement. You can roll over your IRA into a qualified retirement plan (for example, a (k) plan), assuming the retirement plan has language allowing it to accept this. 4 Reasons why you may want to roll over your (k) while you're still with your employer Distribution options. If your IRA is set up as a Roth IRA, there is. Will you need access to funds before age 59½? While you should strive to keep your retirement savings earmarked for retirement, sometimes life throws a. You can contribute to an IRA even if you, or your spouse, are already contributing the maximum to a (k), (b), , TSP or other retirement-savings plan. You can also open an IRA with most kinds of financial services companies, including life insurance companies, banks and brokerage firms. Traditional IRAs have a. Contributing to both a (k) and an Individual Retirement Account (IRA) offers immense benefits: While (k)s often include a match from your employer. An IRA is something you typically get on your own working with financial institution. You can only use a (k) if you have one at your job. On the other hand. Many determined retirement savers contribute to both a (k) and an IRA. You can save up to the respective annual limit in each account, though tax benefits on. Whether your IRA contribution is tax-deductible depends on three factors: For , if you are covered by a retirement plan with your employer, your IRA. Yes, you can have both a (k) and an IRA, although certain limitations apply. If you open a Traditional IRA in addition to your (k), your ability to claim. You can have a (k) and an IRA - they have separate contribution limits. You can make both Traditional and Roth contributions to a (k), but. A K is a type of employer retirement account. An IRA is an individual retirement account. File with H&R Block to get your max refund. File online. Roth (and other) funds: If you have Roth money and pre-tax money in your (k), expect to receive two checks—one for each “money type.” You typically deposit. The answer is yes. It may be a good idea to do it, if you qualify. Here's why: It's about saving the maximum amount and getting the most tax advantages. Combining (k) accounts: How to get started · Gather your most recent (k) and IRA statements. · Collect online rollover or transfer forms and contact.

Set Thailand Stock Exchange

The Stock Exchange of Thailand (SET) is among the most liquid exchanges in Asia, providing a full range of investment products. Thailand Stock Exchange, BOM, Bombay Stock Exchange Limited, Realtime. KLSE National Stock Exchange of India, Realtime. SGX, Singapore Exchange. SET index is the oldest and the most cited equity index in Thailand. It made intraday all-time high at on 27 February , surpassing the previous high. First, international brokers rarely grant you access to the Thai stock market or let you buy stocks in Thailand. The Stock Exchange of Thailand (SET) has. Be a part of connecting the world's financial markets. Discover LSEG careers, search for job opportunities and find right role for you to fulfil your. Thailand SET Index | historical charts for SET to see performance over time with comparisons to other stock exchanges. SET Composite carbon1.ru:The Stock Exchange of Thailand ; Open1, ; Day High1, ; Day Low1, ; Prev Close1, ; 52 Week High1, Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Thailand - Delayed Quote • THB. SET_SET Index (^carbon1.ru). Follow. The Bangkok SET50 Index is a major stock market index which tracks the performance of all common stocks listed on the Stock Exchange of Thailand. The Stock Exchange of Thailand (SET) is among the most liquid exchanges in Asia, providing a full range of investment products. Thailand Stock Exchange, BOM, Bombay Stock Exchange Limited, Realtime. KLSE National Stock Exchange of India, Realtime. SGX, Singapore Exchange. SET index is the oldest and the most cited equity index in Thailand. It made intraday all-time high at on 27 February , surpassing the previous high. First, international brokers rarely grant you access to the Thai stock market or let you buy stocks in Thailand. The Stock Exchange of Thailand (SET) has. Be a part of connecting the world's financial markets. Discover LSEG careers, search for job opportunities and find right role for you to fulfil your. Thailand SET Index | historical charts for SET to see performance over time with comparisons to other stock exchanges. SET Composite carbon1.ru:The Stock Exchange of Thailand ; Open1, ; Day High1, ; Day Low1, ; Prev Close1, ; 52 Week High1, Finance · My Portfolio · News · Latest News · Stock Market · Originals · Premium News Thailand - Delayed Quote • THB. SET_SET Index (^carbon1.ru). Follow. The Bangkok SET50 Index is a major stock market index which tracks the performance of all common stocks listed on the Stock Exchange of Thailand.

The Stock Exchange of Thailand: Web portal. SET Index (SETI) ; 1, +(+%). Closed 30/08 ; Day's Range. 1, 1, 52 wk Range. 1, 1, CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. The HK50 tracks the performance of around 50 largest companies listed in the Stock Exchange of Hong Kong. It is a free floating, capitalization-weighted index. The Stock Exchange of Thailand (SET) is recognized as one of the world's advanced emerging markets with its comparative advantages in liquidity and. Stock Exchange of Thailand Moscow Exchange Saudi Stock Exchange Tehran Stock Exchange set up rules for organized securities trading in New York. Thailand SET Index, TH:SET Quick Chart - (Thailand Stock Exchange) TH:SET, Thailand SET Index Stock Price - carbon1.ru Get THAILAND SET IDX .SETI) real-time stock quotes, news, price and category · Trio of court cases in Thailand ramp up uncertainty, put markets on edge. London Stock Exchange · FX · LCH · Risk Intelligence. Our businesses. Data market-moving headlines plus agenda-setting insight and commentary. Learn more. SET Index Thailand (ZB_): Stock quote, stock chart, quotes, analysis, advice, financials and news for Index SET Index Thailand | Monde: | Monde. The Stock Exchange of Thailand is open Monday through Friday from am to pm and pm to pm Indochina Time (GMT+). The Thailand SET live stock price is 1, What Is the Thailand SET Ticker Symbol? SETI is the ticker symbol of the Thailand SET index. Is Thailand SET a. Below is a list of the Opening, Closing, Current as well as Countdown Times for the Stock Exchange of Thailand (SET). A Complete Thailand SET Index overview by Barron's. View stock market news, stock market data and trading information. SET Index Thailand (ZB_): Stock quote, stock chart, quotes, analysis, advice, financials and news for Index SET Index Thailand | Monde: | Monde. SET Index, , 1,, -1, Trading Value (mln.) , 41,, , Market Capital (bln.) , 16,, , Source: Bank of. The Thai government has set the target of attracting one million wealthy or Have an employment contract with a public company listed on stock exchange. Stock market return (%, year-on-year) in Thailand was reported at % in , according to the World Bank collection of development indicators. It brings you Thailand stock quotes, ETF, Funds, Stock Charts and Finance News. from this stock APP. It synchronizes with web finance data, allows quick. SET Index (SETI) ; 1, +(+%). Closed 30/08 ; Day's Range. 1, 1, 52 wk Range. 1, 1,

Everything To Know About Fha Loans

An FHA loan is a mortgage insured by the Federal Housing Administration. Learn more about FHA loan requirements and compare offers. FHA home loans are geared toward borrowers who have lower down payments or credit challenges that may make it difficult to buy a home. Best of all, the FHA only requires a % down payment for borrowers with credit scores of or higher and 10% for those with a score between and Because FHA loans are insured by the Federal Housing Administration, lenders can provide home loans to borrowers with low credit scores while offering things. Per carbon1.ru, “The Federal Housing administration, generally know as “FHA”, provides mortgage insurance on loans made by FHA-approved lenders throughout the. The Federal Housing Administration insures FHA mortgages to protect the lender in the event a borrower isn't able to pay back the loan. The FHA itself doesn't. This article covers what you need to know about who can use these types of loans and what you need for the FHA approval process. The Federal Housing Authority (FHA) will vouch for qualified borrowers and provide additional insurance against loss, which encourages lenders to approve an FHA. These loans are similar to other mortgage options, with a few exceptions. While most mortgages may require at least a 5% down payment, you can get an FHA loan. An FHA loan is a mortgage insured by the Federal Housing Administration. Learn more about FHA loan requirements and compare offers. FHA home loans are geared toward borrowers who have lower down payments or credit challenges that may make it difficult to buy a home. Best of all, the FHA only requires a % down payment for borrowers with credit scores of or higher and 10% for those with a score between and Because FHA loans are insured by the Federal Housing Administration, lenders can provide home loans to borrowers with low credit scores while offering things. Per carbon1.ru, “The Federal Housing administration, generally know as “FHA”, provides mortgage insurance on loans made by FHA-approved lenders throughout the. The Federal Housing Administration insures FHA mortgages to protect the lender in the event a borrower isn't able to pay back the loan. The FHA itself doesn't. This article covers what you need to know about who can use these types of loans and what you need for the FHA approval process. The Federal Housing Authority (FHA) will vouch for qualified borrowers and provide additional insurance against loss, which encourages lenders to approve an FHA. These loans are similar to other mortgage options, with a few exceptions. While most mortgages may require at least a 5% down payment, you can get an FHA loan.

This guide will walk you through the ins and outs of the FHA loan program to help you answer that question. An FHA mortgage is a government backed loan sponsored by the Federal Housing Administration. Here is everything you need to know about FHA loans. 5 Things Homebuyers Should Know About FHA Loans · They come with annual and up-front fees. · You can use gift funds for your down payment and closing costs. · You. A home loan is simply borrowed money from a lender that allows the buyer to purchase the home and pay back the cost plus interest over an agreed-upon period. Buying your first home? FHA might be just what you need. Your down payment can be as low as % of the purchase price. Available on unit. This article explores the potential uses and advantages of FHA loans, including low down payment requirements, flexible qualification guidelines, and the. The Top 7 Things First-Time Home Buyers Should Know about FHA Loans · A 20% Down Payment is Not Required · FHA Does Not Loan Any Money · FHA Has Very Favorable. One of the biggest advantages of the FHA loan is that it has slightly looser restrictions when it comes to qualifying for the loan. Since the FHA loans are. As long as you meet the minimum credit score, debt-to-income ratio, and other necessary eligibility requirements, you could be FHA pre-approved and pre-. FHA Loan requirements state that the property you are buying must be appraised by an FHA-approved appraiser. · The house you covet may meet FHA requirements, but. An FHA Loan is a mortgage that's insured by the Federal Housing Administration. They allow borrowers to finance homes with down payments as low as % and are. Yes, an FHA loan is possibly the best home loan program for a first-time home buyer with limited access to financial assets. Five Things to Know About FHA Home Loans · #5) FHA Home Loans Versus Conventional Mortgage Down Payments · #4) FHA Mortgages Have No Penalty for Early Payoff. In fact, FHA only requires % down for any approved single family home, condo or townhome. However, If you are a homebuyer that has good credit and 10% or. If you'd like to apply for an FHA loan online or in person, your lender will consider, among other things, your debt to income ratio. This ratio is used to make. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, we'll pay a claim to the lender for the unpaid principal. An FHA home loan is a mortgage that is insured by the Federal Housing Administration. These mortgages are backed by the United States federal government. FHA loan applicants must meet credit-score and down-payment requirements, show proof of employment, and a steady income. An FHA loan is like any other loan, but it's insured by the FHA. It can be easier to qualify for than a regular loan (eg, lower down payment requirements). Because the FHA insurance protects lenders from borrower default, FHA lenders are more willing to offer favorable terms to borrowers who do not meet stricter.

Simple Interest Account

Investment accounts, such as brokerage accounts and retirement accounts, utilize compound interest to help grow the account holder's investment portfolio. Simple interest is indeed, a simple way of calculating the interest on a certain sum of borrowed money. With the simple interest methodology, the amount of. Simple interest refers to the interest earned only on the initial deposit in a savings account. So, if your initial deposit was $, the simple interest would. Simple interest is an interest that is calculated only on the principal amount for any given time period. The formula for simple interest is SI = (PRT)/ Simple Interest. Simple interest is the annual percentage of a loan amount that must be paid to the lender in addition to the principal amount of the loan. Simple Interest (S.I.) is the method of calculating the interest amount for a particular principal amount of money at some rate of interest. For example, when a. Simple interest is the term for the way that the interest charge on a loan is calculated. It's in contrast to compound interest. Ever wonder why a bank pays you interest on your savings? When you. So, the formula for calculating monthly simple interest becomes (P × R × T) / ( × 12). What is Simple Interest Rate Formula? Investment accounts, such as brokerage accounts and retirement accounts, utilize compound interest to help grow the account holder's investment portfolio. Simple interest is indeed, a simple way of calculating the interest on a certain sum of borrowed money. With the simple interest methodology, the amount of. Simple interest refers to the interest earned only on the initial deposit in a savings account. So, if your initial deposit was $, the simple interest would. Simple interest is an interest that is calculated only on the principal amount for any given time period. The formula for simple interest is SI = (PRT)/ Simple Interest. Simple interest is the annual percentage of a loan amount that must be paid to the lender in addition to the principal amount of the loan. Simple Interest (S.I.) is the method of calculating the interest amount for a particular principal amount of money at some rate of interest. For example, when a. Simple interest is the term for the way that the interest charge on a loan is calculated. It's in contrast to compound interest. Ever wonder why a bank pays you interest on your savings? When you. So, the formula for calculating monthly simple interest becomes (P × R × T) / ( × 12). What is Simple Interest Rate Formula?

Compound interest works by periodically adding accumulated interest to your principal—the amount you've put into the savings account—which then begins earning. Simple interest is an interest rate paid only on the amount of money you deposit. If you put $ in an account with 5% simple interest paid annually, at. Find Simple Interest: Example Question #4 Jennifer has invested her money in an account that yields 5% interest per year. If she invested $12,, how much. This calculator computes the simple interest and end balance of a savings or investment account. It also calculates the other parameters of the simple. You want to earn as much interest as possible on your savings but not pay more than you have to when you borrow. One of the biggest factors in both is. A compound interest account pays interest on both your initial investment plus any interest previously accrued. This interest-upon-interest appreciation is the. Discussing interest starts with the principal, or amount your account starts with. This could be a starting investment, or the starting amount of a loan. The formula for calculating daily compound interest is A = P(1 + r/n)^nt. A is the amount of money you'll wind up with. P is the principal or initial deposit. r. Find Simple Interest: Example Question #4 Jennifer has invested her money in an account that yields 5% interest per year. If she invested $12,, how much. Directions: Solve each simple interest problem using the formula I-Prt. Be sure to show all of your steps. 1. Ben deposited $6, into a savings account. Compound Interest means that you earn "interest on your interest", while Simple Interest means that you don't - your interest payments stay constant, at a fixed. It may be simple interest or compound interest. With simple interest the Max deposited $ in a savings account at an interest rate of %. To calculate your total interest earned, you just have to multiply your interest earned each year by the number of years. Interest earned each year is $40, and. For a borrower, simple interest is the amount paid to borrow a certain amount of money. The interest is first taken out when a payment is made before applying. You can calculate the monthly savings interest rate by multiplying the principal or initial balance by the interest, and then multiply again by the time of one. Simple interest is money earned solely on the principal, or the original amount of money deposited.1 It doesn't account for any interest earned over time. Assume $1, is placed into an account with 12% simple interest for a period of 12 months. For the entire term of this transaction, the amount of money in the. Higher interest rates on savings accounts mean greater potential earnings. By depositing money into an interest savings account, you not only keep your funds. It may be simple interest or compound interest. With simple interest the Max deposited $ in a savings account at an interest rate of %. A compound interest account pays interest on both your initial investment plus any interest previously accrued. This interest-upon-interest appreciation is the.